Direct a Qualified Charitable Distribution from your IRA

A Tax-Saving Way to Help First Book

Make a difference today! Connect kids to new books AND save on taxes. It’s possible when you support First Book by directing a Qualified Charitable Distribution through your IRA.

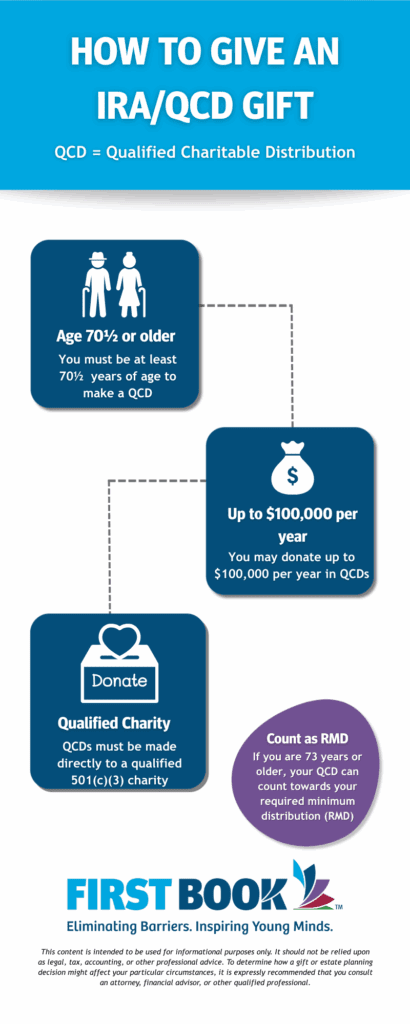

A Qualified Charitable Distribution (QCD) from an Individual Retirement Account (IRA) allows individuals aged 70½ or older to donate up to $100,000 annually directly to a qualified charity, potentially reducing their taxable income. A QCD form is required to initiate this process with your IRA custodian. Contact your financial advisor to determine if this giving vehicle is right for you and your tax situation.

Key aspects of donating a QCD directly to a charity include:

Eligibility: You must be at least 70½ years old at the time of the distribution. If you are 73 years old or older, your QCD can count towards your required minimum distribution (RMD).

Direct Transfer: The distribution must be made directly from your IRA to the qualified charity; it cannot be distributed to you first and then donated.

Qualified Charity: The charity must be a qualified organization, meaning it is eligible to receive tax-deductible contributions. First Book is a qualified charity (Federal Tax ID: 52-1779606).

Annual Limit: The maximum amount that can be excluded from taxable income through QCDs is $100,000 per individual per year.

Form Requirements: You’ll need to complete a QCD form provided by your IRA custodian, which typically includes information about you, the charity, the distribution amount, and instructions for the trustee.

Tax Implications: QCDs are not reported as taxable income, even if you don’t itemize deductions, and they can help reduce your adjusted gross income (AGI), according to Fidelity Charitable.

Reporting: QCDs are reported on Form 1040, and the taxable amount is reported as zero if the full amount was a QCD.

Satisfying the RMD Requirement: If you are 73 years old or older, your QCD can count towards your required minimum distribution (RMD). Example: If you are 73 years old and have an IRA with a required minimum distribution (RMD) of $10,000, you could donate up to $10,000 to a qualified charity via a QCD. This distribution would not be included in your taxable income, and it would satisfy your RMD requirement, according to the IRS.

This content is intended to be used for informational purposes only. It should not be relied upon as legal, tax, accounting or other professional advice. To determine how a gift or estate planning decision might affect your particular circumstances, it is expressly recommended that you consult an attorney, financial advisor or other qualified professional.